Understanding the Language of Sustainability As the push for sustainable packaging grows,…

When Plastic Ingenuity formally established our sustainability organization in 2021, we set out to better understand the needs and motivations of key stakeholders advancing sustainable packaging. These insights shaped our sustainability strategies, leading to initiatives like adopting ISO 14001, creating our Sustainable Packaging Assessment service, and developing innovative sustainable products.

In the ensuing years, including 2024, we deepened this work by hosting live listening sessions with experts from CPGs, retail, and healthcare sectors. Participants, including packaging engineers, procurement specialists, and sustainability leaders, shared their goals, drivers, and strategies. These insights will continue to guide and strengthen our sustainability efforts.

Building upon our 2023 observation, the United Nations Sustainable Development Goals (SDGs) are the predominant guiding principles high-ambition organizations leverage to define sustainability and align their goals. This framework highlights the need for businesses and institutions to assess their economic, social, and environmental impact. “Sustainability means future generations have the resources to meet their needs. We must keep our company economically successful while addressing the needs of customer requirements and other stakeholders in perpetuity,” shared a sustainability professional.

The drivers of change identified in 2024 align with our previous studies’ results. These drivers include consumer preference for sustainable products, non-governmental organization (NGO) influence on corporate initiatives, retailer purchasing power, and legislation. The driver that rose to the top of the list in 2024 is Extended Producer Responsibility (EPR) legislation. EPR policies make producers of products responsible for the entire lifecycle of their goods, including disposal and recycling. In 2024, Minnesota joined Maine, Oregon, Colorado, and California as states that have passed EPR legislation.

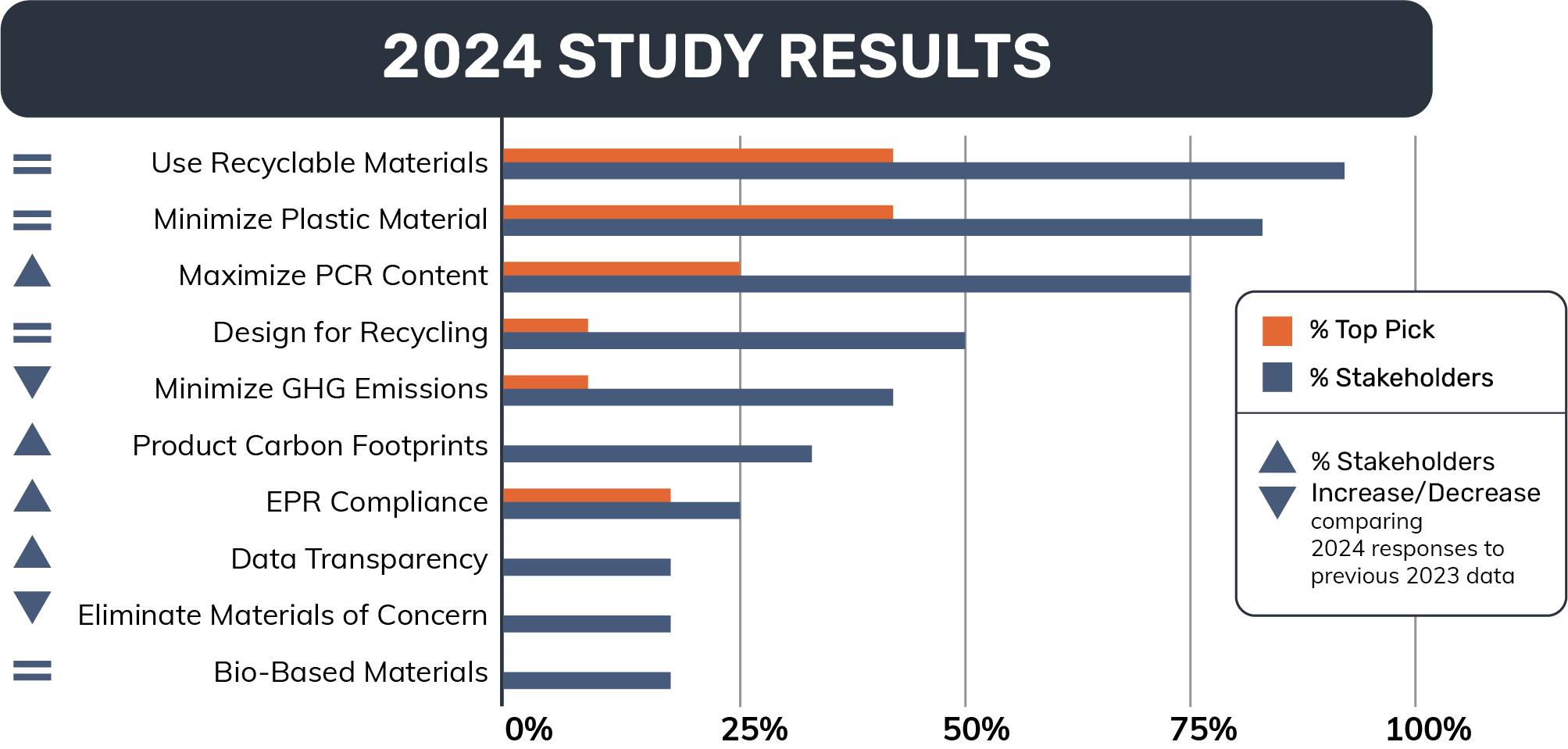

We asked stakeholders to describe their organization’s packaging sustainability goals. We dissected the answers into individual goal statements, and high-priority goals were identified as “Top Picks.” The following table graph summarizes the findings:

The top sustainability goal identified by stakeholders in 2024 was “Use Recyclable Materials,” as 92% of organizations interviewed have a goal related to this aspect, including 42% that denote it as a top pick. Additional top goals include “Minimize Plastic Material,” Maximize PCR Content,” “Design for Recycling,” and “Minimize GHG Emissions.” The results reveal an enduring commitment to transitioning to a circular economy for plastic packaging.

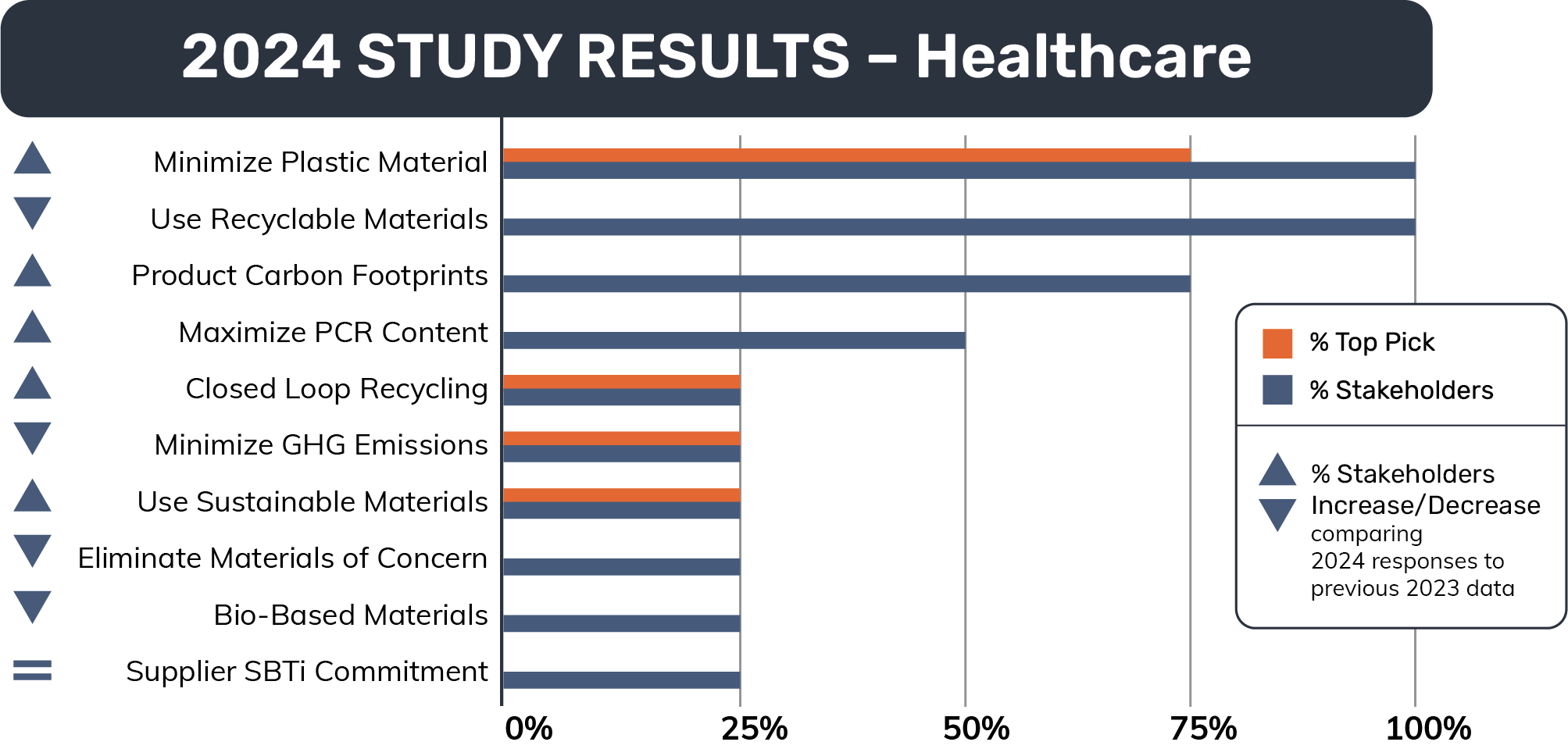

A share of the stakeholders interviewed in 2024 work in the healthcare packaging sector. These organizations include medical device manufacturers (MDMs), pharmaceutical companies, biotech products, and life science applications.

The top sustainability goal identified by healthcare stakeholders in 2024 was to “Minimize Plastic Material,” as 100% of organizations interviewed have a goal related to this aspect, including 75% that denote it as a top pick. “Use Recyclable Materials” was cited by 100% of healthcare organizations as a goal they are working toward. However, none listed it as a top pick. Healthcare stakeholders are focused on implementing life cycle assessment principles into their development processes to quantify the embodied carbon of their products and minimize environmental impact throughout the entire life cycle.

Brands, retailers, and healthcare organizations continue to prioritize the transition to a circular economy for packaging. This commitment is reflected in the growing number of sustainability goals focused on packaging circularity and the creation of dedicated teams to implement these initiatives. Beyond circularity, stakeholders are also working to measure and reduce the embodied carbon in their products and packaging to lessen their climate impact. Legislation, such as Extended Producer Responsibility, is seen as both a catalyst and a support mechanism for this transformation. As many organizations face challenges in achieving their voluntary circularity targets, regulatory measures will play a crucial role in driving progress in the coming years.

EPR continues to secure roots in the U.S. Circular Action Alliance (CAA), the Producer Responsibility Organization (PRO) tasked with leading the effort to compliance, recently submitted the final program plan to the Oregon Department of Quality. The program plan details how Producers of materials covered will achieve compliance to the state’s EPR law. The plan includes estimated base fees, which vary by material type, required to fund the program. The state’s first reporting deadline, March 31st, 2025, is quickly approaching. The complete program plan can be accessed here: CAA Oregon EPR Program Plan.

We were recently highlighted in a Packaging Dive article regarding industry’s efforts to increase PET thermoform reclamation. The article can be accessed here: Thermoform reclamation rises along with rPET demand | Packaging Dive.

Amount of PET thermoforms recovered in U.S. and Canada in 2023

Increase in amount recovered from 2022 to 2023

Average percentage of Post-Consumer Recycled PET in thermoforms in 2023, up from 10.8% the previous year

If you are attending the following events, we hope to see you there and look forward to connecting: